If you’re new to investing in stocks and shares or you’re finding that the strategy that you’ve been using recently isn’t working for you, it’s right to want to do some learning. There’s a lot that you need to understand and get right if you’re going to develop an investing strategy that’ll give you the best chance of long-term and lasting success.

Finding the right approach to investing isn’t necessarily easy and there are lots of things you should consider in order to craft the correct strategy. The things we’re going to talk about today will help you do exactly that.

So read on now and find out about all the things you can do to start developing a successful and sustainable approach to investing, whether you’re new to it or you’re merely looking for a change of direction.

Set relevant investment goals

Before you get started, you need to set some relevant investment goals. For you to do this, you should think about your reasons for investing and what you think success would look like. Because everyone has different long-term aims and different ideas of what investing success might look like, it’s something that only you can do. Those goals will be different for everyone, and they’ll give you something to work towards as you get started with your new approach to investing.

Start with a low-risk diversified portfolio

When you first start putting together your new portfolio, it’ll make sense to start with a relatively low-risk and, ideally, a diverse portfolio. When your portfolio is diverse, it’s less risky and means there’s less for you to worry about. When you have an undiverse portfolio of stocks, you’ll be at risk if one or two of those stocks fails you. But that won’t be the case if your portfolio is diverse. That’s entirely the point of making your portfolio diverse; it limits losses and reduces the overall risk you’re exposed to.

If your portfolio is less diverse, you’ll need to monitor carefully and closely

If you do end up with a portfolio that’s not particularly diverse for whatever reason, it’ll mean that you have to take a slightly different approach to monitoring that portfolio. It still makes sense to be looking to diversify the portfolio if you can, but in the meantime, you should also pay closer attention to the portfolio. You need to be extra careful, understand market trends and be ready to take action swiftly if it’s required. That kind of thing isn’t so pressing when you have a diverse overall portfolio.

Ensure your strategy is a long-term one

When it comes to investing your money sensibly, it always makes sense to take a long-term approach. You never know what might go wrong if you take the short-term day trading approach. It’s a very high risk strategy and lots of people are caught out by it. If you want steady and relatively reliable returns on your investments, it’s much better to take the long-term approach to investing. Any strategy that you formulate and begin to implement should be about long-term gains rather than getting rich quick.

You can’t predict the market with 100% accuracy, but you can learn from it

There’s never any way of predicting the market with any kind of real accuracy, especially not when you’re a beginner at all this. Instead, you should try to learn from it. When something happens that you weren’t expecting to happen, you should try to learn from that experience and take into account when making future moves in the market.

Learning as you go is the best thing you can do; there’s no point pretending that you can predict where the market is going to head next. After all it is experience that makes you perfect.

If you are dealing in forex trading then why not use one of the best free forex signals, as they are designed to alert you whenever a potential trading opportunity arises.

Reinvest your earnings to create a compounding effect

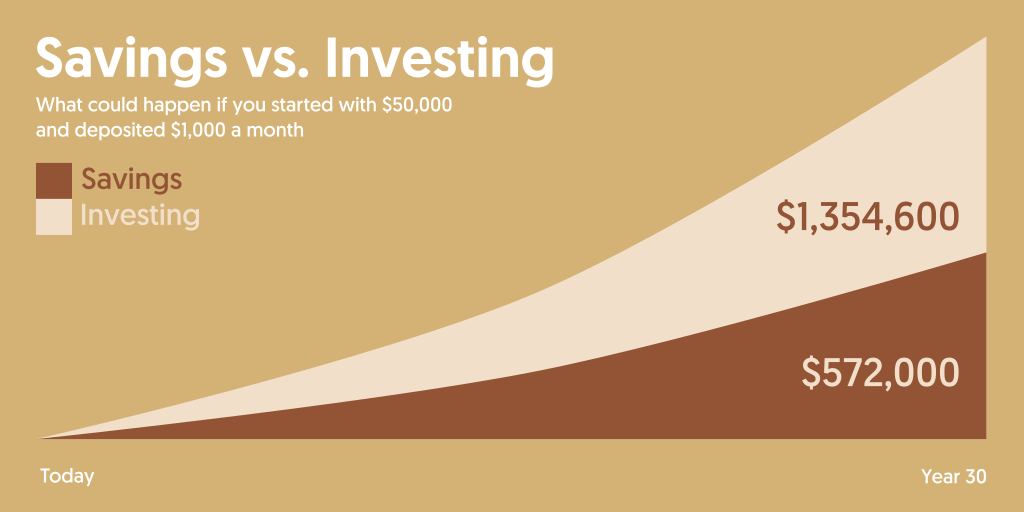

Reinvesting your stock market earnings is something that you should definitely try to do if you want to create a compounding effect.

When you reinvest the money you’re making, it means you’ll continually have a stream of money going back into your portfolio, helping to expand it. That’s what the compound effect is. It’s about putting the dividends you earn back into your portfolio. If you do this right, you’ll make more and more money and your pot will grow over time.

Endure short-term turmoil, even if it’s tough to do so

It’s important that you remain in control when you’re going through a rough patch with your investments. If you simply cave in under the pressure and panic, you’ll end up selling at a loss when you don’t necessarily need to. If you can weather the rough patches, you’ll live long enough to see those prices rebound in many cases, and then you can sell at a profit. Panicking very rarely pays off for investors, even if it’s very tempting to simply sell when you see stock values fall a little. Don’t let that happen to you.

Plan a time horizon for each investment

Planning a time for when you can sell your investments is important. When you make a trade and acquire stocks, you should always be thinking about what your strategy is for exiting the trade.

Do you want to hold onto these stocks for years?

You have to have a lot of long-term confidence in them for that to be your strategy.

Perhaps you can see their short-term potential for returns and intend to sell them relatively soon. That’s fine too, but make sure you’ve already thought through the justifications for your strategy.

Consider a dollar cost averaging approach

A dollar cost averaging approach to investing is one that you might want to consider and explore if you’ve never done so before. It’s a way of investing the same amount of money on a regular basis, no matter how many stocks that amount buys you. This keeps things consistent and rules out marketing timing strategies, which is no bad thing.

You still have to know where to put your money and which stocks are worth your time, but you don’t have to think so much about how much to invest.

Diversify with different kinds of investments

It makes sense to make your business as diverse as it possibly can be. When you have a diversified portfolio, it’s much less risky for you. It means you can afford for the prices of one or two stocks to fall without it hitting the overall profitability of your portfolio. If you have a range of stocks but don’t do any other kind of investing, you might want to consider forex; fx signals are a great way to improve. That’s the kind of diversification you should be looking towards.

Remember that holding a stock is not the same as forgetting about it

Just because you’re holding a stock, that doesn’t mean you should just forget about it. You should carry on monitoring its performance and find out how it’s doing for you.

This might impact your decisions regarding your next steps and when you might want to exit the trade. Even if with a long-term investing strategy, it pays off to keep an eye on how your investments are performing for you.

Don’t fall for market timing

Market timing is almost always a mistake, and people think they can achieve success with it regardless. A lot of people overestimate their own abilities, or underestimate the challenges posed by finding success on the stock market.

You can’t time the market in a way that’s going to achieve reliable outcomes for you.

Always carry out research into a company before investing in it

It’s always a good idea to carry out research into any company you’re thinking of investing. The last thing you want is to buy a ton of stocks in one company and then to find that the company has a lot of red warning signs hanging over it with regard to its potential future stock value.

You want to find out any signs of problems ahead of time, and they can apply to individual businesses as well as to particular industries.

Think about the wider economic and market forces that might impact future value.

Carry out regular portfolio reviews

It’s a good idea to carry out portfolio reviews on a regular basis when you’re managing your stocks and shares. Take a look at how your portfolio is performing and the areas in which you might want to trim the fat and make changes.

There are always things that can be improved, and you might not notice the things that need to be changed until you really take the time to look closer at your portfolio. These reviews shouldn’t be skipped if you want to keep it in the best shape possible.

Developing a successful approach to investing isn’t easy, and there’s no silver bullet solution that you can adopt. Most of the newcomers seeks for some short and easy solution. However, It is about making the most of the advice above and ensuring you go about it carefully, leaning as you go. If you do that, you’ll eventually develop a strategy that’s profitable for you.

Leave a Reply