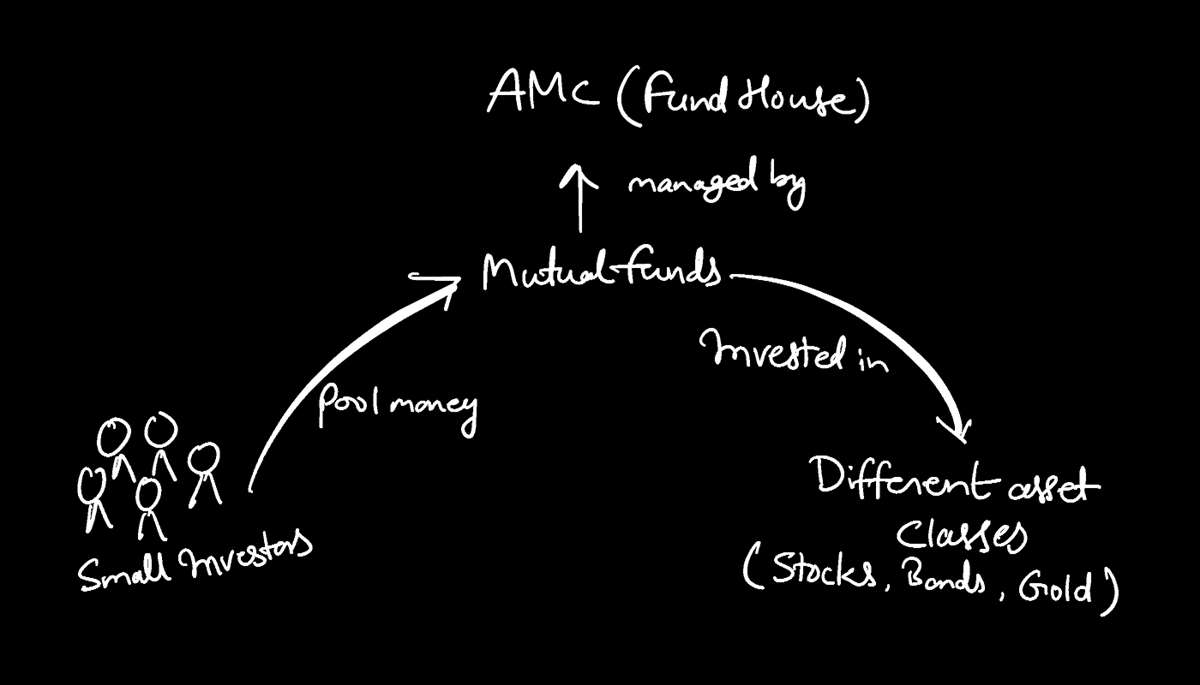

A mutual fund is a type of investment instrument consisting of stocks, bonds, metals, and similar other securities. In mutual fund, the fund house collects money from small-small investors and invests it in web diversified securities.

For a better accountability of every single investors, all collected investments are divided into small units in a folio that represents mutual fund’s value in real-time.

This way, mutual funds give small or individual investor an edge to invest in well managed and diversified portfolio even with small amount. On the other side, fund house earn from managing your investments, which is known as expense ratio.

Definition of Mutual Fund.

A mutual fund is a type of investment instrument that pools money from multiple small investors to invest in a diversified portfolio of stocks, bonds, or other securities which is managed by a fund house and its experienced fund managers.

Investors buy shares in the mutual fund, and the value of those shares is determined by the performance of the underlying securities in the fund’s portfolio.

It offers a good diversification and management, making them an accessible investment option for a wide range of investors with different financial goals and risk tolerances.

These fund houses are also known as Domestic Institutional Investors (DIIs).

Atul Kumar Pandey from AtulHost

Understand How It’s Working With a Real-Life Scenario.

For example, take HDFC AMC as the fund house who manages many mutual funds under it and look it into its very basic HDFC Index Nifty 50 mutual fund. It consists of India’s top 50 listed companies and investing in all 50 companies will require huge capital which is not feasible for small investors. So fund house make a well diversified portfolio and breaks it down to fractions so that anyone with little fund can also invest.

Here, HDFC AMC is an asset management company, which is also known as a fund house. HDFC Index Nifty 50 is a mutual fund scheme where an investor can begin his/her journey to securities market.

Benefits and Risks of Mutual Funds.

Mutual funds offer diversification, professional management, accessibility, and a variety of options like setting up SIP (Systematic Investment Plan), SWP (Systematic Withdrawal Plan), switching to different fund of same fund house, etc.

However, they carry risks like sudden market fluctuations, fund manager’s performance, fees, lack of control, and liquidity issues. Understanding your goals and risk tolerance is essential before investing, and seeking advice from a professionals like financial advisors or a SEBI registered advisor can help navigate these benefits and risks effectively.

Please do not take advice from a bank employee, in my own experience they are just fools who likes to just make commission by involving you in any scheme. I have seen every bankers selling such schemes for handsome commissions.

Good advice from registered financial advisor may cost you initially, but they will never ever misguide you; instead, they will let you know benefits and risks of investing in a fund. You can even tell them curate a list of mutual funds for different investment horizons.

Technical Jargon Used in Mutual Fund Schemes.

Now let’s look into some terminologies used in such schemes.

1. Lump Sum Investment:

Just like it sounds, one time investment similar to booking a fixed deposit. Investors who just opt for large investment in a mutual fund scheme go with lump sum investment.

Typically, seasoned investors who have access to enough funds and looks for an opportunity (when market has fallen enough) in the securities market invest in lump sum.

2. Systematic Investment Plan (SIP):

Unlike lump sum in this method, an investor set a fixed amount to be invested monthly in a mutual fund scheme, very much like we do in recurring deposits. Investors can also choose on which day the SIP amount should be debited from his savings account, which is set with a mandate and gets invested in mutual funds.

It is best method for those investors who have less fund but a regular income and wants to invest in the securities market. Using SIP mode of investment, they can average all the ups and down and make handsome returns over a long period of time.

It is similar to installments, but you are investing for a bigger goal, which is wealth creation.

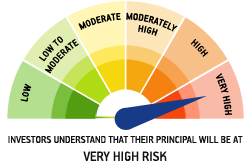

3. Risk Factors (Risk-O-Meters):

Every mutual fund is different, so they all have different risk factors too. Like equity mutual funds invest in direct stock markets so they are risky, bonds and debentures mutual funds are medium risky, and liquid mutual funds are way less risky. But do note that only higher risks can help you generate higher returns; similarly with low risks you can only generate less returns, but it will be fixed and mostly stable return.

It is mandatory for mutual fund house to show this in their every scheme so that the risk-taker (investor) understand what level of risk he/she is taking to reach the set goals.

4. Net Asset Value (NAV):

It is the current value of a single unit of a mutual fund scheme. Its value keeps on changing every day (as stock/money markets move). NAV changes only visible after a day.

For instance, if market has fallen too much and you wish to take advantage of buying more units of mutual fund scheme in same value, it is better to invest before today’s cut off time. This way you will get same day NAV in your investment account/folio.

5. Asset Under Management (AUM):

AUM means how much funds they have gathered from small investors and invested the same in scheme. Usually, strong AUM also shows credibility of a scheme.

6. Benchmark:

Every mutual fund scheme follows a benchmark so that they can show some counting return. Like “Nifty 50 Index” have given around 12-15% annual return in last few years, so if you buy any index mutual fund which replicates the Nifty 50 Index, you can estimate that this much return is possible. Additionally, it should beat the benchmark because stocks under index funds also offer dividends which is reinvested and that do not happen in Nifty 50.

You also have an option to review whether they are able to beat the index or not. If not, then they are underperforming, and you should switch to some other fund house or scheme.

Keep in mind that you can only switch in same fund house, for different fund house you need to withdraw from first fund house and then invest to second fund house.

7. Entry Load:

Some fund house has sales charges or loads, so they charge entry load. Usually, direct mutual funds do not have such entry load fees, and you should opt for those only.

8. Exit Load:

Just like entry load, there are exit load too.

You will pay some fee to fund house when you exit from their scheme. Most of the time, such fee is less than 1% and debited directly from the scheme.

9. Lock In:

There are some mutual fund schemes that lock you in from exiting from it. Like, ELSS tax saver funds, usually help you save tax by allowing you to stay for long run like 3 years.

This way you eliminate the short-term and long-term capital gain taxes which are charged when you sell it early within a year of investing in a scheme. Do note that in India, you will be taxed differently based on how time you have held a fund before you sell it.

- STCG – 20% for the short-term capital gains when sell it within a year.

- LTCG – 12.5% for the long-term capital gains if they reach ₹1 lakh in a fiscal year.

Note: In recent budget, Nirmala Sitaraman announced that STCG is increased from 15% to 20% and LTCG is increased from 10% to 12.5%. Which is huge setback for many.

Holding for long run is more lucrative as you get ₹1 Lac of tax-free buffer for every additional year you hold it. For instance, if you have invested ₹1,00.000 in a mutual fund through lump sum mode and left it for 10 years. Let’s assume it has become ₹6,00,000 after 10 years then using indexation benefits your tax is nil as you have ₹9 Lac of tax-free buffer.

10. Total Expense Ratio (TER):

Total expense ratio is the annual maintenance charge levied by mutual funds to finance its expenses. Like – annual operating costs, including management fees, allocation charges, advertising costs, etc. So that will be charged from your investment amount directly.

For instance, HDFC Index Nifty 50 has TER of 0.20%, means when you invest ₹10,000 in the scheme then ₹20 will be deducted from it before investment. To make sure you don’t pay a huge fee, invest in direct mutual funds only, otherwise this fee could double or triple just because you buy it indirectly from banks or an agent.

So, this is the detailed introduction and definition of mutual fund with benefits and risks associated with it, including all the technical jargon you read and listen in documents.

Leave a Reply