There are numerous reasons why you need to borrow money. For those with a high credit score, you may not have difficulty in acquiring a low-interest rate loan. However, a bad credit rating makes it quite challenging to qualify for such loans.

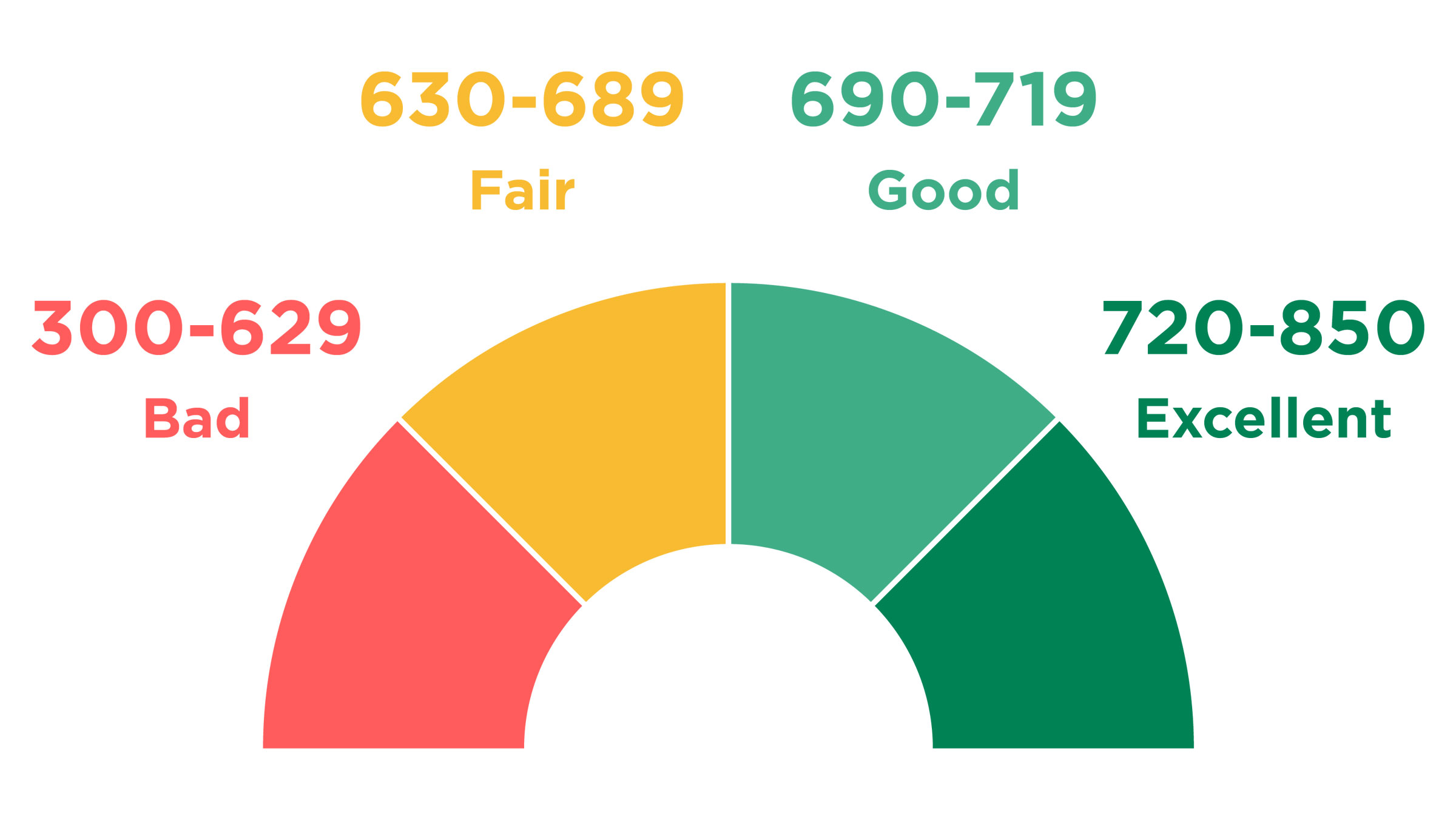

The picture below shows the credit ratings and their interpretations.

Since it can take years to fix a credit score, you may be able to find a lender who accepts borrowers with medium to low credit scores. Fortunately, there are a lot of options available, which would show you how to qualify for a small business line of credit.

Most people do not realize the importance of credit ratings at the beginning and regret it when faced with the consequences. Paying your bills late or having your credit card limit maxed out does have an impact on your credit score.

Having a low credit score not only makes it difficult for you to acquire loans when you need them, but it also makes these loans expensive. The interest rate increases proportionally if your credit ratings are low.

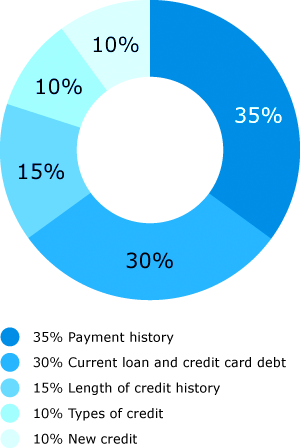

The chart at right shows how to calculate credit ratings.

Fortunately, not all lenders give priority to credit ratings when approving loans. Some of the ways you can procure loans are listed below.

1. Join a credit union.

One of the main advantages of credit unions is their tendency to give out loans to people with low credit ratings. Credit Unions function like banks, but they do not evaluate you solely on credit ratings.

However, they only give out these loans to their members, so you have the tough task of convincing them to make you a member.

They judge by analyzing your financial health but also give importance to your work history, your education, and the area of your residence. So, if you are already a member of a credit union, you can apply for a loan, or you can search for different credit unions located near you.

The non-profit status which is received by various credit unions allows them to be exempt from paying income taxes and are willing to accept riskier clients, who are often rejected by the banks. Due to this, they can give you flexible terms along with a lower interest rate payout ratio when compared to a bank.

2. Talk to different lenders and look for the best option.

Once you are ready to apply for a loan, you should review all the choices you have. Instead of negotiating with a bank, you can decide to negotiate with the private dealers who can offer you a loan at a cheaper rate compared to the bank.

Since banks have to deal with many regulations, the deals they offer are strict and might not be feasible for you in the long term. You can also search for online lenders who are willing to work with borrowers with a lower credit rating and offer bad credit loans to them. Websites like Fundera or Credible allow borrowers to see different offers from lenders, and they can choose the ones most beneficial to them. These lenders are more flexible as compared to the banks and can offer you a deal most suitable for you.

3. Try for a secured loan.

As borrowers with a bad credit history are judged with the potential of a default, they are given loans easily if they can offer some of their assets as collateral. If you are willing to provide your house, car, or any other asset against the amount of the loan, then you will have a higher chance of qualifying for a loan. That’s because the lender would have a financial backup in case you default on your loan.

Mortgages, home equity loans, and auto loans are examples of secured loans because you are offering collateral for the money that you are borrowing, although a secured credit card can also be considered a kind of secured loan as well.

Getting access to secured loans is not too difficult since lenders who offer unsecured loans such as banks and credit unions will also have the option of providing secured loans. However, getting access to a secured loan is not something to celebrate. If you are unable to pay it back on time, the lender would have the power to seize whatever asset you offered as collateral.

In short, only go for a secured loan if you are confident that you can repay it on time.

4. Consider a home equity loan.

If you possess considerable equity in your house, you have the option of using it to secure a loan. The money can be used without giving too much importance to the credit history. The credit score is not considered when you apply for a home equity loan if you have a considerable amount of equity.

Moreover, these loans have a fixed interest rate and a payment period. You can borrow money for up to thirty years, and the interest rate can be tax-deductible if you make improvements in your house during the time duration.

However, there are some downsides to acquiring this kind of loan. By taking a home equity loan, you are putting up your house as collateral and hence run the risk of losing your property if you fail to pay back the loan at the required time.

Also, many of these loans have additional charges that can quickly accumulate. Additionally, you need a certain quantity of home equity to qualify for these loans. In any case, make sure you do your research if you decide to pursue a home equity loan. It would be better to contact an expert if such type of loan would be suitable in your case.

5. Bring a co-signer.

Since credit ratings are worth a lot when you are getting a loan, it is better to bring someone along with you who possesses a high credit rating. The primary function of a co-signer is that it gives the lender the guarantee that he would get his money back on time.

A co-signer is responsible for making the payments to the lender if the borrower is unable to due to some circumstances –acting as a guarantor. One of the main advantages of bringing a co-signer is that it would increase your chances of getting a loan since the co-signer offers a guarantee.

If you bring a co-signer along with you when you try to negotiate for the loan, make sure that he is aware of his responsibilities in advance to limit confusion when it’s time to make payments.

Conclusion.

In a nutshell, getting the money that you desperately need will look complicated if you have a bad credit rating. Fortunately, it is not impossible, and you might secure one with relative ease if you take the appropriate steps at the right time. You should be familiar with your credit score and try to find your shortcomings before applying for the loan.

Make sure you analyze the pros and cons of each type of loan that you are applying for and try to shop around to find the best possible loan for you. In case you are not satisfied with the loans offered to you; you always have the option of borrowing the necessary money from your family and friends if all the traditional options fail.

Now that you finally have the necessary information to get a loan with poor credit ratings, you should meet with a loan officer and start working on managing your debts responsibly to improve your credit ratings for another loan in the future.

Leave a Reply