Implement robust identity verification processes through multifactor authentication, ensuring a layered approach to user access control. Biometric solutions, such as fingerprint or facial recognition, add an extra barrier against unauthorized access.

Regularly update cryptographic protocols to safeguard data during transactions. Transitioning to advanced algorithms, such as elliptic curve cryptography, fortifies the protection of sensitive information against potential breaches.

Engage in continuous monitoring of transaction patterns using anomaly detection systems. This allows for the identification of fraudulent activities in real-time and enables immediate intervention to mitigate potential losses.

Adopt decentralized storage solutions for sensitive information to remove reliance on central points susceptible to attack. Utilizing blockchain technology for record-keeping not only enhances transparency but also provides a tamper-proof mechanism for data integrity. Integrating web3 security services ensures these systems are fortified against evolving threats inherent to decentralized ecosystems.

Establish a comprehensive incident response plan tailored to address cybersecurity threats specific to this environment. Conduct regular simulations and training exercises to ensure teams are prepared for various attack scenarios.

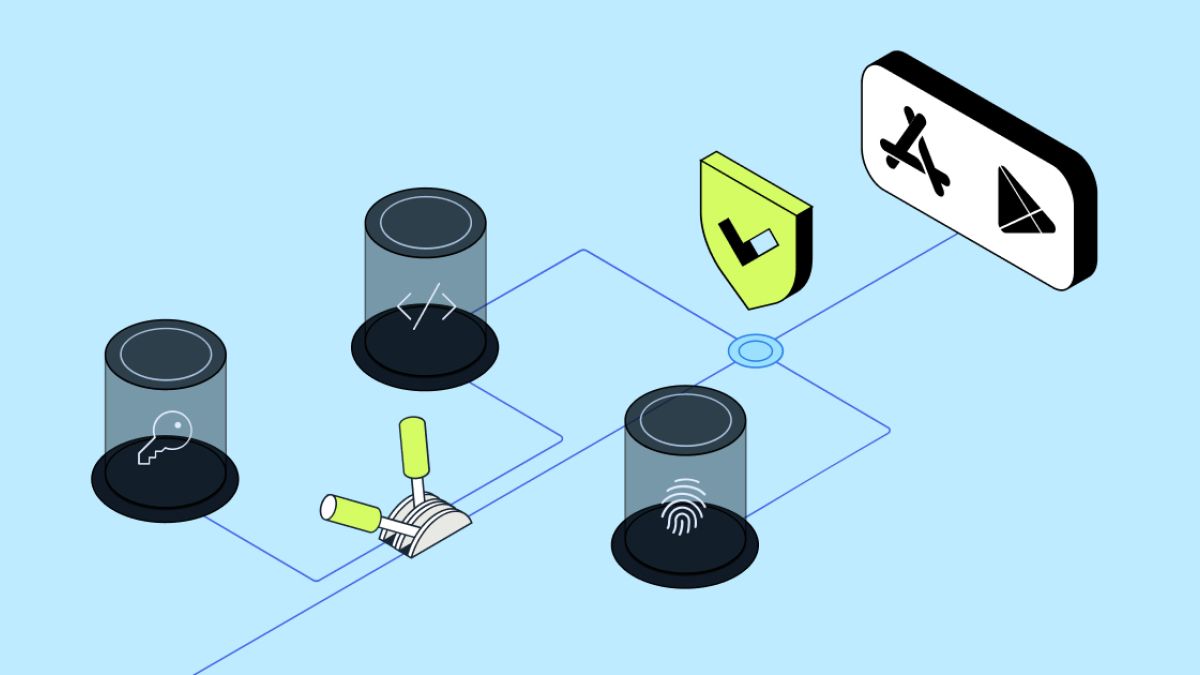

Implementing Robust Authentication Mechanisms for Web3 Platforms.

Adopt multi-factor authentication (MFA) to enhance user verification. This method combines something the user knows (password), something they have (authentication app or hardware token), and something they are (biometric data). Implementing MFA drastically reduces unauthorized access risks.

Utilize Decentralized Identity Solutions.

Integrate decentralized identity frameworks like Self-Sovereign Identity (SSI) protocols. These systems allow users to manage their identifiers independently, minimizing reliance on centralized databases and reducing points of failure.

Smart Contracts for Access Control.

Employ smart contracts to define access permissions for users and applications. Smart contracts can automate authorization processes by validating transactions based on predefined conditions, thus enhancing trust and transparency in user interactions.

Regularly update and audit authentication processes to adapt to emerging threats. Conduct penetration testing and vulnerability assessments to identify weaknesses in your protocols. Educate users on best practices for password management to empower them against phishing attempts.

Identifying and Mitigating Smart Contract Vulnerabilities.

Conduct thorough code audits using both automated tools and manual reviews. Tools like Mythril and Slither can identify common issues such as reentrancy and integer overflow. Manual inspections help capture logic errors that automated tools might miss.

Implement testing frameworks such as Truffle or Hardhat to create comprehensive test suites. Use unit tests and integration tests to ensure each function performs as expected under various conditions. Simulations of real-world scenarios can uncover unforeseen weaknesses.

Utilizing Formal Verification.

Employ formal verification methods to mathematically prove the correctness of contract logic. Tools like Coq and Isabelle assist in this rigorous process. While resource-intensive, it provides a high assurance level of the contract’s behavior and can detect subtle flaws.

Establishing Upgradable Patterns.

Design contracts with upgradability in mind. Use proxy patterns to allow modifications without losing data or disrupting service. This approach facilitates swift updates in response to vulnerability discovery, reducing the window of risk for stakeholders.

Establishing Compliance with Regulatory Standards in Digital Finance.

Implement robust Know Your Customer (KYC) procedures to verify identities. Utilize technology for efficient data collection and analysis to enhance compliance with Anti-Money Laundering (AML) requirements. Regularly train employees on the latest regulations and best practices, ensuring they are aware of identification and reporting protocols.

Continuously monitor transactions for suspicious activity using advanced analytics and machine learning algorithms. Establish a real-time reporting system for flagged transactions to maintain adherence to legislation.

Incorporate smart contracts where feasible for automated compliance checks. Regularly audit these contracts to verify their alignment with evolving legal frameworks.

Collaborate with regulatory bodies to understand forthcoming changes in legislation. Engaging with public consultations can provide insights into regulatory intentions and requirements.

Utilize a compliance management system (CMS) that integrates all necessary compliance activities in one platform. This facilitates real-time tracking and reporting, streamlining compliance processes.

Consult with legal experts specializing in financial regulations to ensure that your operations align with local and international standards.

Conduct periodic risk assessments to identify vulnerabilities in your compliance framework. Adjust your strategies based on these assessments and emerging threats in the digital finance space.

Leave a Reply